Balloting results for Digital Core REIT IPO are out. Post-IPO Digital Core Reit will have right of first refusal to a potential pipeline of more than US15 billion of data centres - both existing and under construction.

Digital Core Reit Ipo New Pure Play Data Centre In Sg With 4 75 Yield

The full SGX announcement is here but Ill summarise quickly and share my takeaways.

. At its indicative IPO price of US088 Digital Core REITs distribution yield is estimated to be 475 for the year ending 31 December 2022. With a total of some 267 million shares to be sold this issue is likely to be raising around US235 million 320 million. Digital Core REIT or DCR is a pure-play data centre REIT offering a total of 267 million units at US088 per unit to raise total gross proceeds of US977 million.

What I did not like about Daiwa House Logistics Trust was. Less than a week after Daiwa House Logistics Trust was listed there is another REIT - Digital Core. Digital Realty Trust will hold a 39 interest in Digital Core REIT post IPO assuming the overallotment is not exercised.

Known as the Digital Core REIT it will be the second data centre-focused REIT to list on the Singapore Exchange SGX after Keppel DC REIT made its debut in 2014. Digital Core REIT is expected to have a gearing ratio of around 27 below its listed peers in Singapore. Here is the net debt-to-asset this will be different from what is published comparison.

Post-IPO Digital Core REIT will have right of first refusal ROFR to a potential pipeline of over US15 billion of data centres - both existing and under construction. Digital Core REIT is a pure-play data centre REIT with properties in the US and Canada. At its indicative IPO price of US088 Digital Core REITs distribution yield is estimated to be 475 for the year ending 31 December 2022.

The Real Estate Investment Trust REIT which owns 10 freehold data centres in the United States and Canada worth around 14 billion is. The Singapore public offer is offered at 121 per unit. If exercised then Digital Realtys stake will drop to 333.

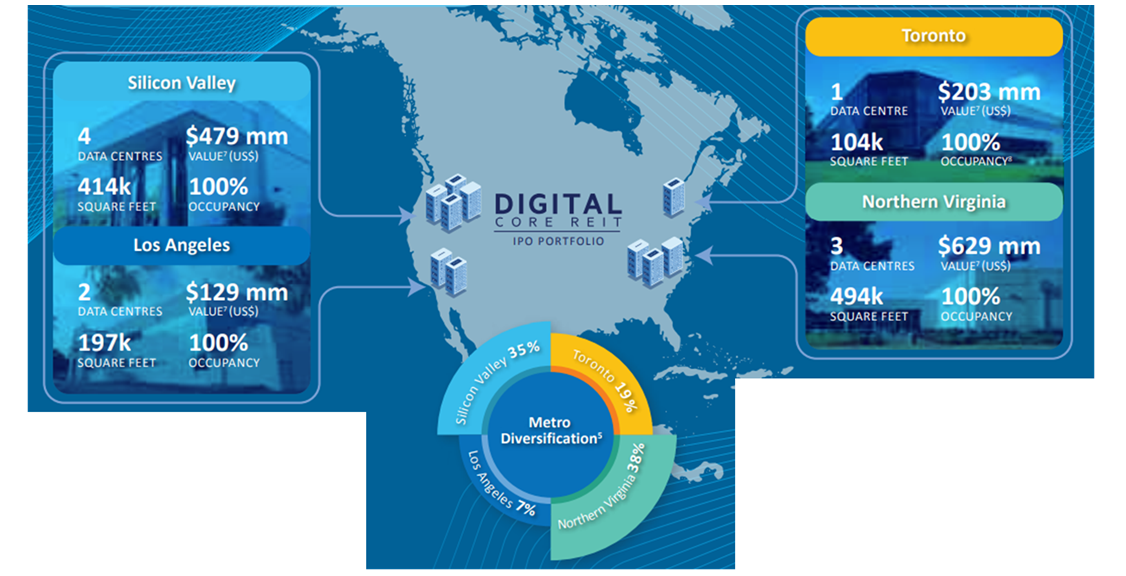

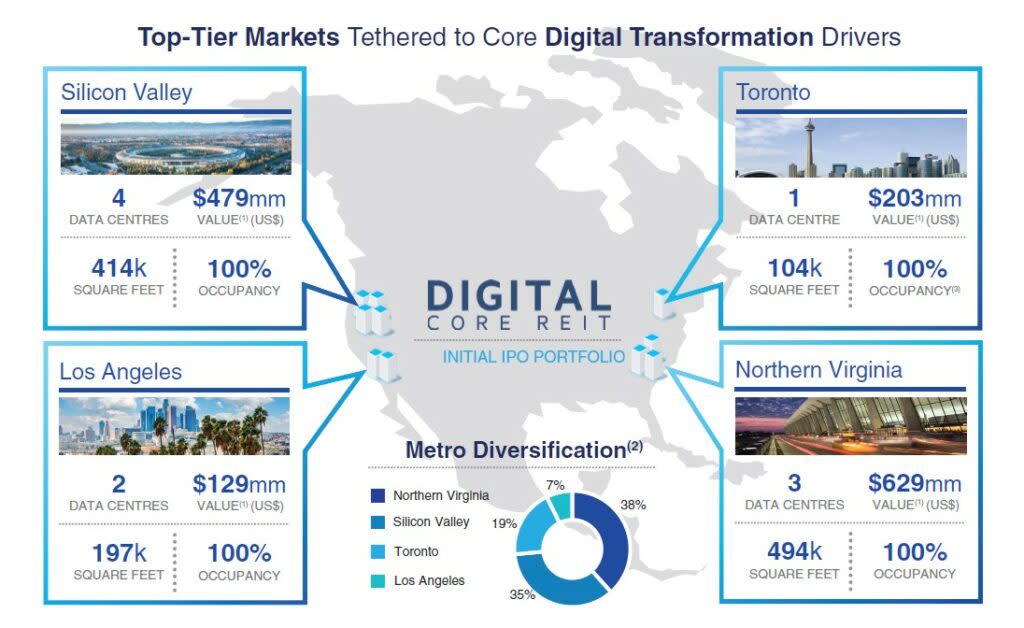

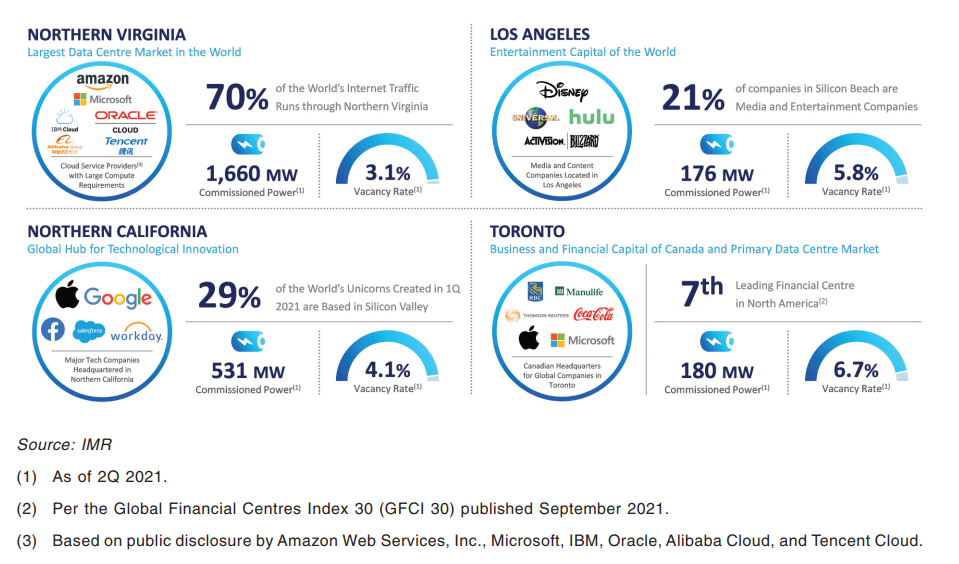

Its impending listing comes hot on the heels of Singapores first REIT IPO this year Daiwa House Logistics Trust SGX. Digital Core REITs IPO portfolio includes 10 high-quality data centres spread across 4 top-tier markets in the USA. In light of certain positives that has been pointed out by others this to me looks like a really bad deal.

PURE play data centre real estate investment trust Reit Digital Core Reit intends to raise total gross proceeds of US977 million from its initial public offering IPO on the Singapore Exchange including the issuance of the sponsor units cornerstone units and parent US Reit preference shares. The sponsor also holds a direct stake of 381 in the REIT itself. Digital Core REIT.

Digital Core REIT DC REIT is offering 267034 units at US 88 cents per unit for its IPO of which 13352m will be for the public and the rest via placement. Digital Core REIT DC REIT is the second pure play data centre REIT that is planning to list in Singapore. Digital Realty Trust is moving forward with its plan to list a data centre-focused REIT in Singapore via an initial public offering IPO.

Hot on the heels of last weeks IPO of Daiwa House Logistics Trust SGX. Forecast distribution yield for 2022 is 475. The assets that make up the IPO portfolio are core to the Sponsors investment strategy and would continue to hold a 10 direct ownership stake in the Digital Core REIT properties.

The local bourse is enjoying a breath of fresh air in the form of new IPOs. Digital Core REIT IPO - Fundamental Summary from IPO Prospectus Vince Thursday December 02 2021 DCR Digital Core REIT 0 Comments. Digital Realty as the Sponsor will be the largest unitholder of Digital Core REIT with a US390 million or approximately 39 ownership stake as at the listing date.

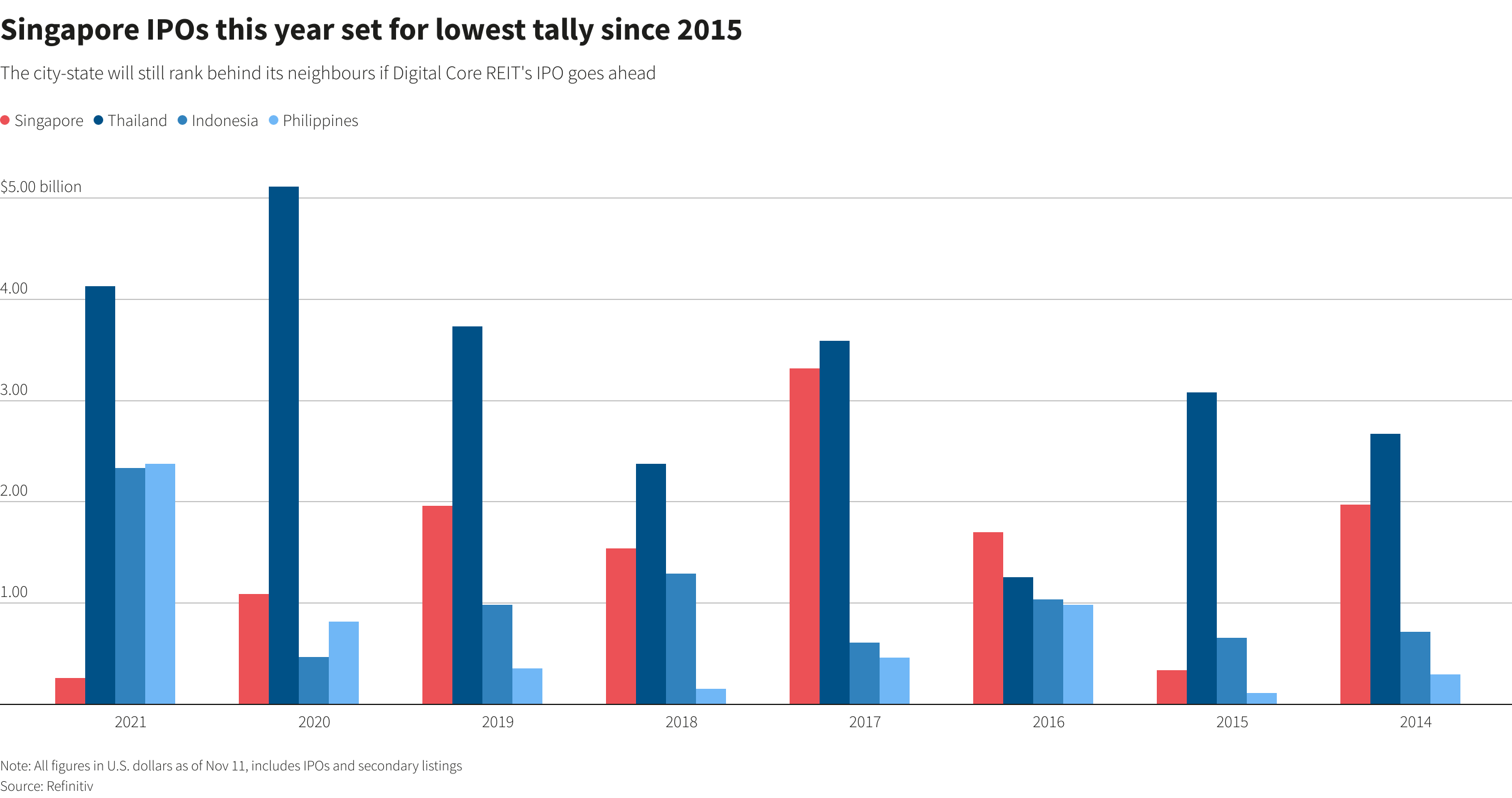

Digital Core REIT sponsored by US-listed Digital Realty Trust is set to raise 600 million in an initial public offering IPO in Singapore the largest listing in the city-state this year. Digital Core REIT IPO Balloting Results Placement Tranche The placement tranche for Digital Core REIT IPO was 253682000 Units US223 million. I was really hyped for this IPO but i guess i will be avoiding it after all.

Digital Core REIT is expected to have a gearing ratio of around 27 below its listed peers in Singapore. Digital Core Reit IPO intends to raise total gross proceeds of US 977 million. 4 in Silicon Valley 2 in Los Angeles 1 in Toronto and 3 in Northern Virgina.

Its a pure play data centre S-REIT and sponsored by the largest global owner operator. - Digital Core REIT sponsored by US-listed Digital Realty Trust is set to raise 600 million in an initial public offering IPO in Singapore the largest listing in the city-state this year the company said in its prospectus on Monday. Digital Core Reit is the only pure-play data centre Singapore Reit with 10 data centres located in key robust and diverse markets.

Applications for the Singapore public tranche of Digital Core REITs initial public offering IPO opens on 29 November at 9 pm. Digital Core REIT is a Singapore REIT established with the principal investment strategy of investing directly or indirectly in a diversified portfolio of stabilised income-producing real estate assets located globally which are used primarily for data centre purposes as well as assets necessary to support the digital economy. The IPO has been priced in the local currency at SGD121 per unit based on the exchange rate of USD100 to SGD1375 as determined by Digital Core REITs manager.

The year end IPO rush has picked up with yet another IPO filed. Here is a brief overview of the indicative offering details from DC REIT preliminary prospectus. 475 FY2022 and 526 FY2023 We cannot just look at the dividend yield alone but the relative leverage of the three REITs.

Digital Core Reit to raise US977m in IPO selling units at US088 each PURE play data centre real estate investment trust Reit Digital Core Reit intends to raise total gross proceeds of US977 million from its initial public offering IPO on the Singapore Exchange including the issuance of the sponsor units cornerstone units and parent US Reit preference. On Nov 22 Digital Core REIT which owns a portfolio of data centres filed to go public at an indicative price of 88 US cents per unit. Keppel DC Reit trades at a PE of 2236 while Digital Core Reit trades at an implied PE of 28 upon IPO.

It was 196 times subscribed. DHLU comes Singapores second REIT IPO this year. As Digital Core REITs final IPO prospectus is not out yet some details are not available.

IPO Price will be US088. The IPO will close on 2 Dec 2021 at 12pm. It is good to note that Digital Core REIT will own 90 of each asset while their sponsor Digital Realty will own the remaining 10.

As Digital Core REITs final IPO prospectus is not out yet some details are not available. All of the over-allotment. The total appraised valuation of the 10 assets in the.

Similar to the initial portfolio the sponsor intends to co-invest in 10 per cent of. Nov 29 2021 Digital Core REIT.

Ascendas Real Estate Investment Trust Areit Sp Announced That It Will Acquire A Por Real Estate Investment Trust Real Estate Investing Industrial Real Estate

Digital Core Reit To Raise 600 Mln In Singapore S Biggest Ipo This Year Nasdaq

Digital Core Reit Ipo Review Why I Am Subscribing For This 4 75 Yield Reit Ipo Of The Year Financial Horse

Digital Realty Ties Refinancing To Sustainability Targets Files Prospectus For Singapore Reit Ipo Dcd

Digital Core Reit Ipo Another Data Centre Reit To Be Listed Here On 6 Dec

Digital Core Reit Set To Raise 600m In Singapore Ipo Asia Financial News

Digital Core Reit Ipo New Pure Play Data Centre In Sg With 4 75 Yield

Digital Core Reit Is Offering A 4 75 Distribution Yield Is This Sustainable

4 75 Yielding Digital Core Reit Is A Premium Reit Ipo My Thoughts Investment Moats

Digital Core Reit Ipo New Pure Play Data Centre In Sg With 4 75 Yield

Digital Core Reit Ipo Review Why I Am Subscribing For This 4 75 Yield Reit Ipo Of The Year Financial Horse